Health Insurance Options

It is obvious how expensive health care can be. That’s why it is very important to have health insurance, so you are prepared for when you or your family have medical needs.

Health Insurance allows you to:

- Be prepared for the unexpected

- Get preventive services like checkups, that are covered 100%

There are several options when choosing your health insurance.

- Marketplace Health Insurance or ACA

- Short Term Medical Insurance

Most health plans must cover a set of preventive services without charging you a copayment or coinsurance, when done at a network provider such as:

- Abdominal Aortic Aneurysm screening for men of specific ages who have smoked

- Alcohol Misuse Screening and Counseling

- Aspirin use to prevent cardiovascular disease for men and women of certain ages

- Blood Pressure screening for all adults

- Cholesterol screening for adults of certain ages or at higher risk

- Colorectal Cancer screening for adults over age 50

- Depression screening for adults

- Diabetes (Type 2) screening for adults with blood pressure

- Diet Counseling for adults at higher risk for chronic disease

- HIV screening for everyone ages 15-65, and other ages at increased risk

- Immunization vaccines for adults

- Obesity screening and counseling for all adults

- Sexually Transmitted Infection prevention counseling for adults at higher risk

- Syphilis screening for all adults at higher risk

- Tobacco Use screening for all adults and cessation interventions for tobacco users

Marketplace or ACA

There are different types of Marketplace health insurance plans available to meet different needs. Some plans restrict your provider choices or encourage you to get care from the plan’s network of doctors and hospitals.

Depending on the number of plans offered in your area, you may find any or all of these types of metal levels—Bronze, Silver, Gold, and Platinum. As the colors suggest, the benefits are more enhanced as you move from Bronze to Platinum.

There are pros and cons for each option. It is important to choose the right option based on your needs. This is what you need to know as your get started:

- Open Enrollment is from November 1 to December 15 for a January 1 start date. When enrolling December 16- January 15, it will start Feb 1. There are special instances that allow you to enroll at other times throughout the year, such as losing group health coverage or a change in Medicaid status

- In some instances, you can get tax credits to help pay for your health insurance

ACA insurance is required to provide Essential Health Benefits for all plans, you will see additional benefits when we compare them side by side in the Marketplace. It includes the following general categories:

- Ambulatory patient services (or outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care (before and after your baby is born)

- Mental health and substance use disorder services (including counseling and psychotherapy)

- Prescription Drugs

- Rehabilitative services and devices (to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

- Laboratory services

- Preventive and wellness services and chronic disease management

- Pediatric services including oral and vision care

Contact us for more explanation and help in selecting the right policy for you and your family.

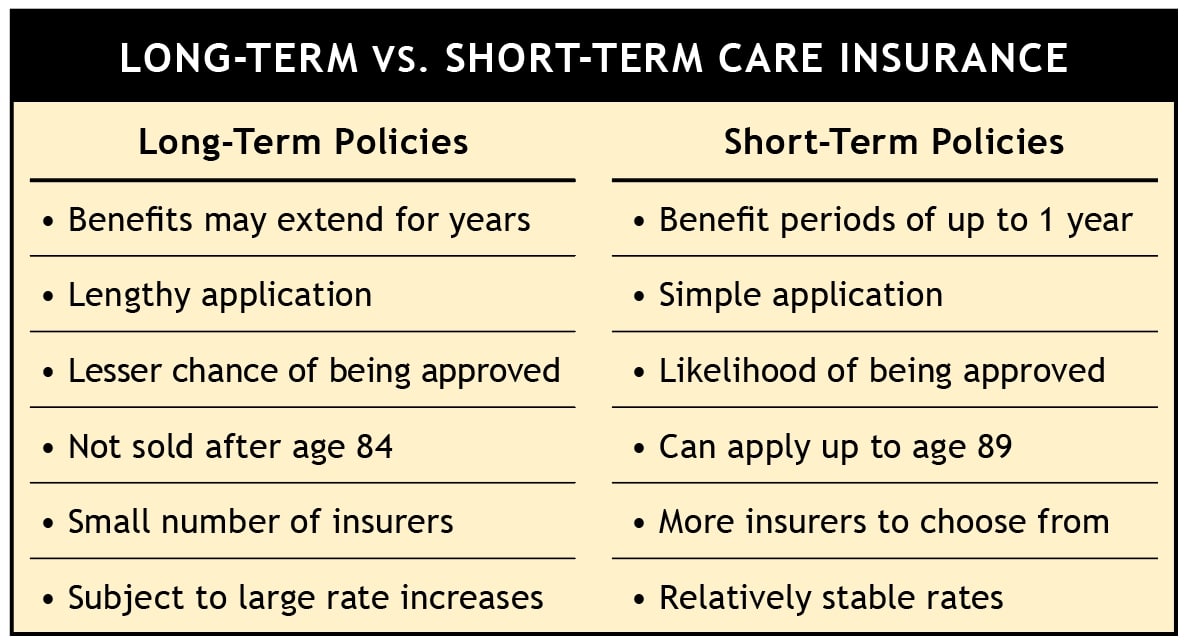

Short Term Medical Insurance

These types of plans are a great alternative for consumers looking for major medical coverage that did not qualify for subsidies on ACA or bridging a gap from group insurance to an open enrollment period without a qualifying event or waiting for a new job insurance to become effective. These plans are not regulated by ACA, therefore can be written anytime throughout the year.

Benefits of Short-Term Medical:

- You can start the coverage quickly, maybe even the next day.

- You can drop this coverage without any penalties.

- You can choose from a range of premiums, deductible,s and benefit maximum amounts.

- You can apply for another term of coverage if needed.

- You can choose your own doctor and hospital without restriction but may be less expensive by using their network providers.

- These are great for healthy people but were not designed to cover all of the Essential Benefits of ACA

- Some plans are renewable for up to 3 years.

These plans typically will not cover your routine office visits, maternity, mental health or preventive care. They do not cover pre-existing conditions and DO require underwriting. This means someone with a lot of health issues may not be able to get this type of coverage. Be sure to check the list of exclusions on any plan.

Give us a call to find out if short term insurance is an option for you.