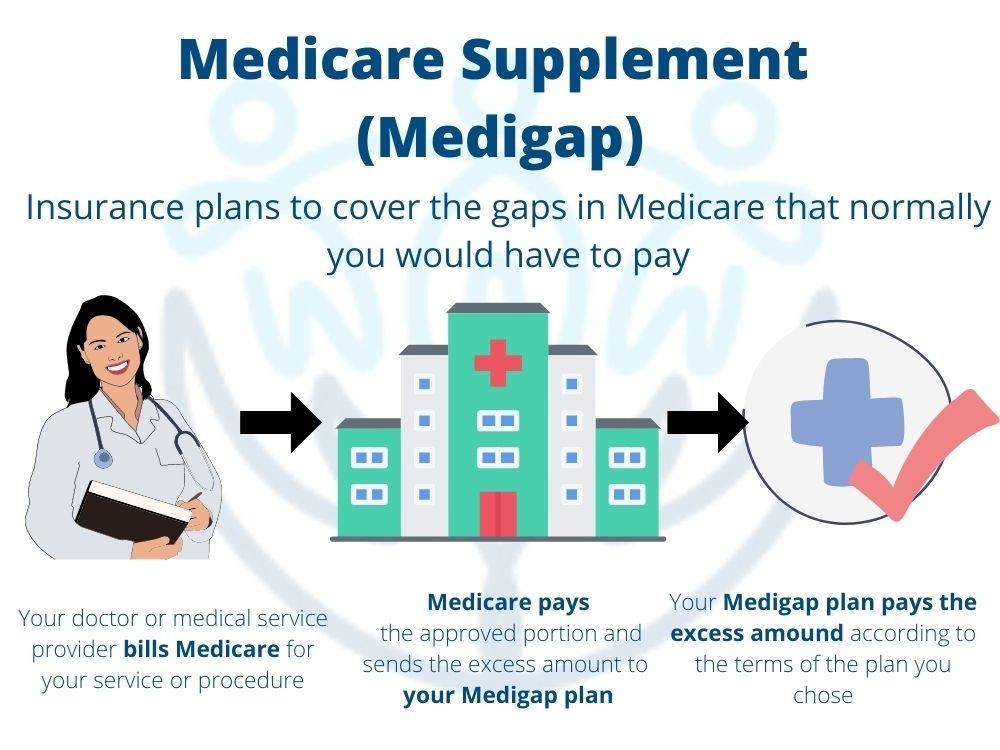

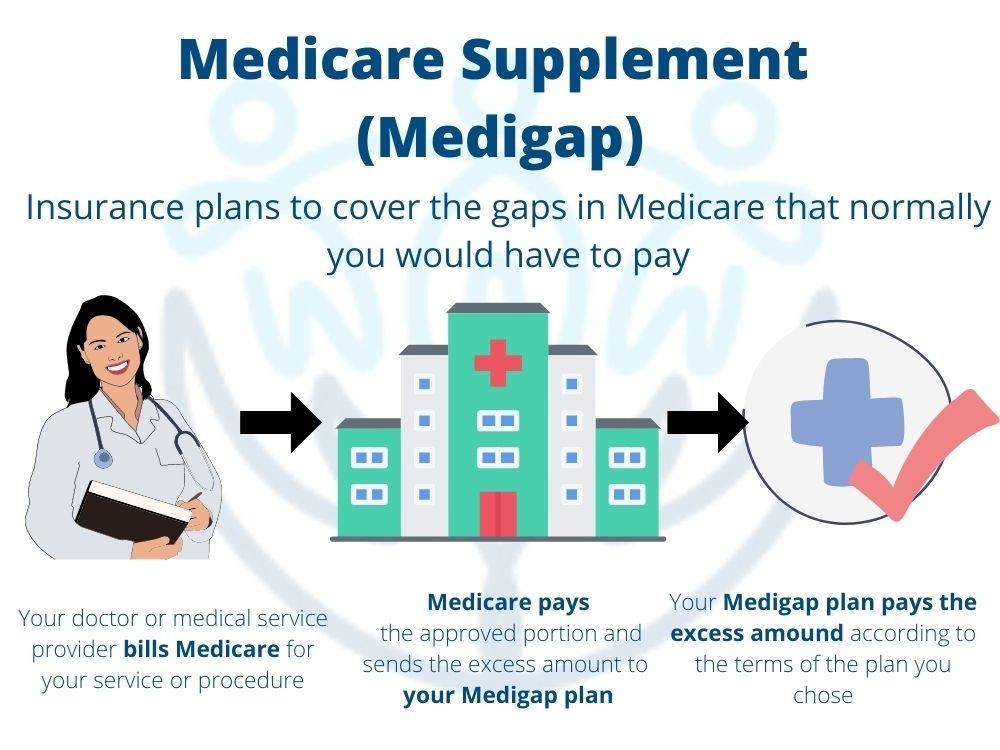

This is insurance sold by private insurance companies, that can help pay some of the health care costs that Original Medicare does not cover, such as co-payments, coinsurance, and deductibles. This insurance “supplements” Original Medicare. Original Medicare pays first and then the supplement pays its portion. A Medigap plan is different from a Medicare Advantage plan. Medicare Advantage is a way to get Medicare benefits, but Medigap supplements your Original Medicare benefits.

What you should know about Medigap plans:

- You must have Medicare Part A and Part B.

- If you have a Medicare Advantage Plan and wish to go back to Original Medicare with a supplement, first make sure you can leave the Advantage plan, then you can enroll in the Medigap plan before the policy begins.

- You pay a monthly premium to the private insurance company for your supplement, but you must also pay the Part B premium to Medicare.

- A Medigap policy can only cover one person. If you and your spouse want a Medigap plan, then you need to get 2 separate policies.

- You can get a supplement from any carrier licensed in your state to sell one.

- Any standard Medicare Supplement policy is guaranteed renewable, even if you have health issues. This means the insurance company can not cancel your Medigap policy if you pay the premium.

- Prescription Drugs are not covered in a Medigap policy, if you want drug coverage you will have to join a Medicare Prescription Drug Plan (Part D) offered by private insurance companies.

- It is illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan unless you are switching back to Original Medicare.

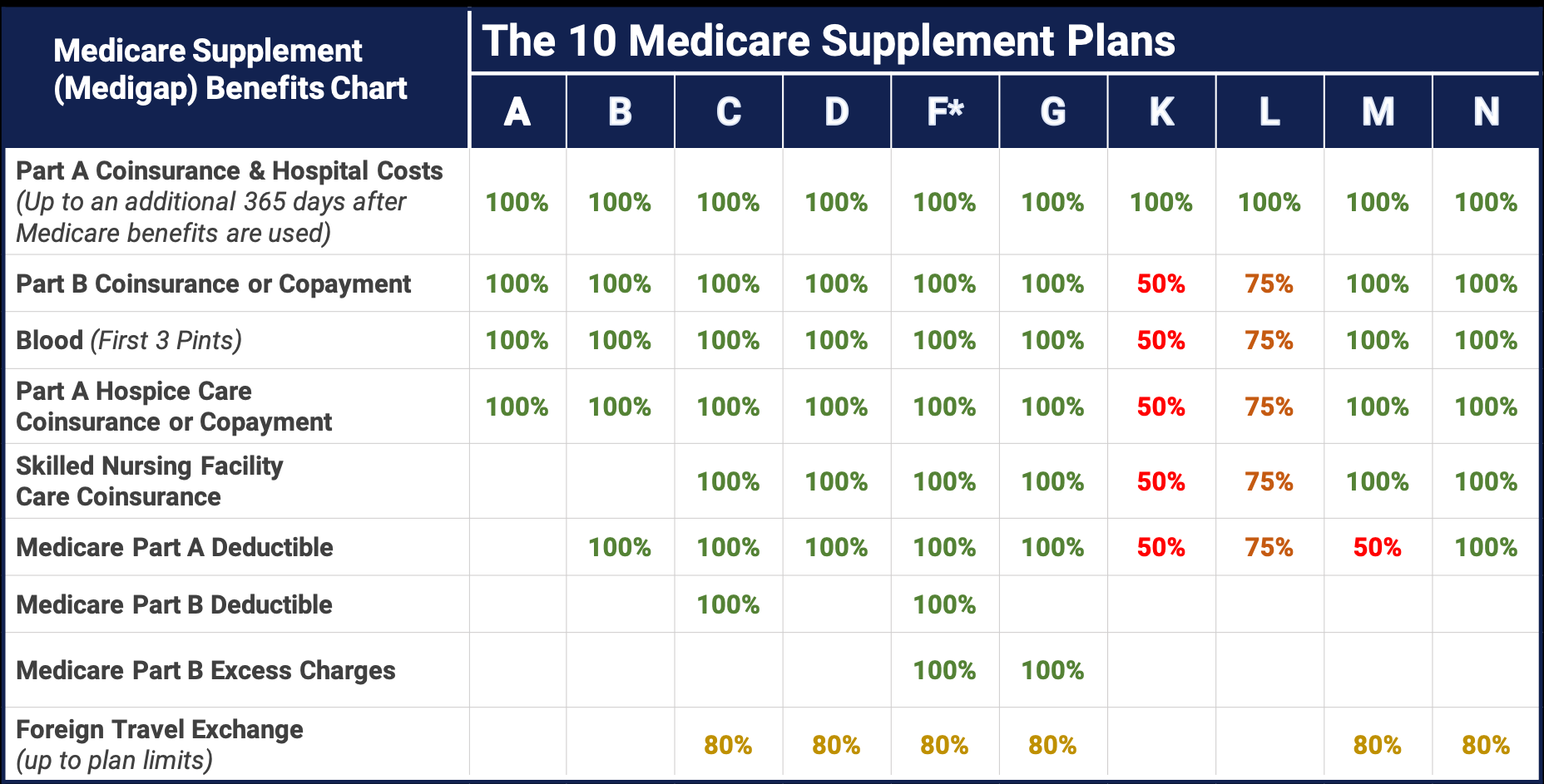

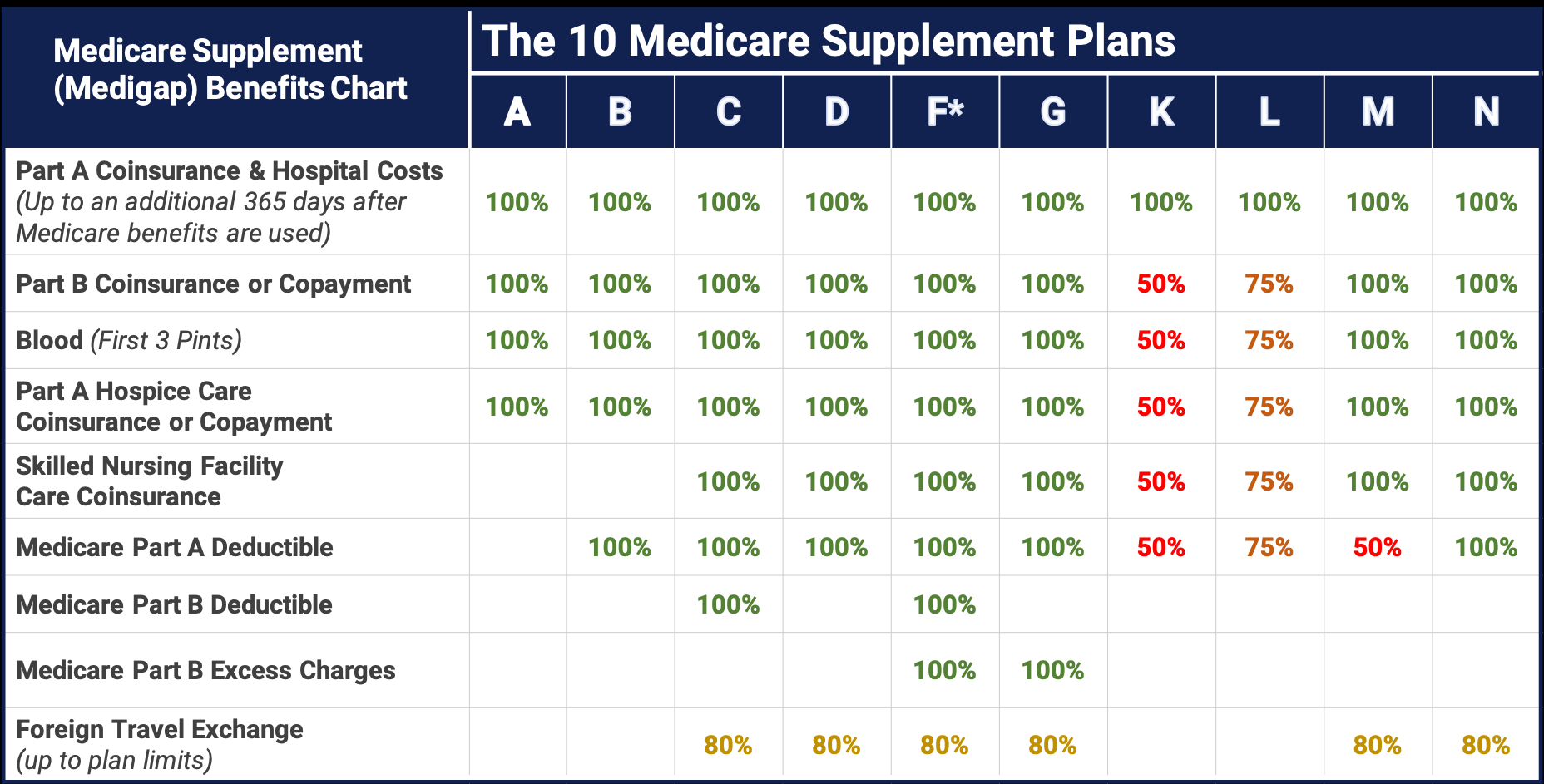

Comparing Medicare Supplements

Medicare Supplement policies are the same across the US and must follow federal and state laws designed to protect you. Insurance companies can only sell a “standardized” policy categorized in most states by letters. (See the chart) All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. As you can see from the chart, there are many options to choose. As licensed agents, we can help you understand these plans and choose the right plan for you.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque in dui nisl. Suspendisse scelerisque, ligula eget fermentum mollis, est lectus interdum nibh, et lobortis lorem enim ornare quam. Nullam vel pharetra diam, id dictum felis. Proin consectetur gravida aliquet. Phasellus quis accumsan dui, eu hendrerit eros. Cras sagittis metus eu felis suscipit, a consectetur sem consequat. Praesent imperdiet rhoncus tortor. Mauris sed iaculis metus, ut consequat magna. Donec eleifend mauris non placerat ultricies. Donec porttitor blandit est, sed mattis sem dignissim eu. Sed at dolor non leo feugiat semper. Donec elementum feugiat congue. Donec interdum velit ac metus pulvinar, accumsan scelerisque nunc facilisis. Integer at condimentum ligula, eget rhoncus metus.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Quisque in dui nisl. Suspendisse scelerisque, ligula eget fermentum mollis, est lectus interdum nibh, et lobortis lorem enim ornare quam. Nullam vel pharetra diam, id dictum felis. Proin consectetur gravida aliquet.

Short-term care refers to a wide range of medical and non-medical assistance to get people back on their feet following an accident, illness, or surgery. It typically lasts several weeks or a few months, or sometimes longer depending on the severity of the condition being treated. Short-term care options include skilled nursing rehab, home health, home care, and respite. The biggest difference between long term and short-term care is the length of time needed to recover and the goal of care.

Benefits:

- Issue ages 18-89

- Daily benefits up to $450 and benefit periods up to 360 days

- Elimination periods of 0 or 20 days

- No prior hospital stay required

- Guaranteed renewable if you pay the premium

- Benefits are paid directly to you to use as you need

- Restoration of benefits

- Optional additional riders available

- More affordable than long term care insurance