Life Insurance Explained

Life insurance is a policy in which the insurer pays out the agreed death benefits to the named beneficiaries at the policyholder’s death. There are many reasons people take out these plans:

- Used to pay for your funeral and final medical expenses

- Used to pass on a legacy to your dependents, create an estate, or give a donation to your favorite charity

- Used if the primary income earner in the household passes, to safeguard your dependents against financial hardship and losing the family home to debt

Types of Insurance

Term Life Insurance-insurance you pay for during a specific amount of time or term, from 1 to 30 years

- You get to select the amount of the death benefit to meet your needs

- These policies are great options when used to help cover the cost of a mortgage for spouses and dependents

- Covers short-term needs and debts

- Can pay for your kid’s college education

- Premiums can be paid monthly, quarterly, semi-annual, or annually, they will be a set amount during the term

- These do not accumulate cash value, therefore offer lower premiums than other life insurance products with the same face value

- Payout excludes suicide and other self-inflicted conditions

Universal Life Insurance-permanent insurance that has the potential to accumulate cash value with an investment savings component.

- Allows you to adjust your death benefit and premiums to accommodate your protection needs

- Guaranteed death benefit (income tax-free)

- The accumulated cash value is tax-deferred

- You can access your cash value to supplement your retirement, pay for education, or other personal needs

- Can skip premium payments if your account has sufficient value to be taken from accrued value

- Has the potential to earn a higher rate of return than a whole-life policy, but the rate could drop

Whole Life Insurance-insurance that remains active throughout a policyholder’s life unless you surrender the policy or stop paying premiums

- Death benefits can be selected to meet your needs and are guaranteed

- Premiums are fixed and can be paid monthly, quarterly, semi-annual or annually,

- Policy accumulates cash value that grows on a tax-deferred basis

- The monthly premium is higher than the term policy because you gain cash value

- Can borrow against it for any reason, but must be paid back with interest or the amount will be deducted from the payout to your beneficiary at the time of your death

- Guarantees 100% return on premium

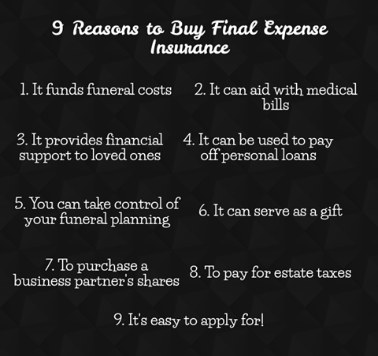

Final Expense Insurance– insurance that helps provide the money needed to pay medical bills, funeral expenses, legal fees, or unpaid bills

- Helps protect your loved ones from unnecessary financial stress when you die

- Typically covers you to age 100

- Simpler to obtain than whole-life or term policies

- Offers never changing premiums with permanent coverage

Funeral Expenses include the funeral service, cemetery plot and headstone, cost of the casket and funeral procession, the meal or celebration of life. Don’t make your loved ones worry about costs when the only thing they should worry about is grieving.

Simplified Issue Life Insurance

- You need to answer some medical questions but not medical reports or exams required

- Coverage amounts available range from $1000 to $150,000

- Term options include a 10 year term, 15 year term,20 year term, 25 year term or term to 100 policy

- Term to 100 and whole life policies provide lifetime coverage at a guaranteed fixed rate

- Some permanent insurance policies include cash surrender values and reduced paid up insurance

- Most policies have an accidental death benefit that pays 1 to 5 times the base amount

- Some companies have a living benefit which pays up to 50% of the death benefit in the event you are diagnosed with a terminal illness where the life expectancy is less than 12 months

- Non- smoker rates are usually reduced by 20 to 40%

Guaranteed Issue Life Insurance

- Guaranteed acceptance with no medical questions

- Coverage amounts available range from $5000 to $25,000

- Premiums and face amounts may be guaranteed for life

- The accidental death benefit of 1 to 5 times the death benefit is often included

- If natural death occurs during the first 24 months of coverage, the premiums are reimbursed with interest, full coverage starts on day 1 of month 25

- Some companies have a living benefit that pays up to 50% of the death benefit in the event you are diagnosed with a terminal illness where the life expectancy is less than 12 months

There is a direct correlation between premium rates charged and risk. The fewer the health questions asked on the application, the higher the risk to the companies and higher rates. The more elaborate the underwriting process is the lower the risk and the better the rates.

Which insurance is right for you?

The answer depends on what you are trying to accomplish by having a life insurance policy. If you are concerned about providing income to a spouse for life, funding retirement, or passing wealth to a future generation, then your permanent life insurance is better suited to meet those goals. If it is for a temporary goal, then term insurance is probably best. Ask yourself why you need your life insurance policy.

Call us today to talk about all of your options and pricing so your family doesn’t have to worry about it tomorrow.