Medicare is a health insurance program for: Part A Hospital Insurance– Most people do not pay a premium for this as they have paid it through their payroll taxes while working. Medicare Part A covers inpatient care in hospitals, skilled nursing facilities (not long-term care), hospice care, and home health care. Part B Medical Insurance –Most people pay a monthly premium for Part B which can change every year. Medicare Part B helps cover doctors and outpatient care, physical and occupational therapy, and some home health care. You can get a penalty if you do not take Part B when you are eligible, and you pay every month for the duration of your coverage. Part D Prescription Drug Coverage-Most people will pay a monthly premium for this coverage which can change every year. Part D helps lower prescription drug costs. Private insurance companies provide coverage. If you decide not to enroll in a drug plan when first eligible, you will pay a monthly penalty for the duration of the coverage. Usually, you are eligible for Medicare if you or your spouse worked for at least 10 years at a job that paid into Medicare and you are 65 years old. If you are not 65, you might also qualify for coverage if you have a disability or End- Stage Renal disease (kidney failure or transplant) or Lou Gehrig’s disease. You can get Part A at age 65 without paying a premium if: You can get Part A if you are under 65 without having a premium if: Even though you don’t have to pay a premium for Part A under those conditions, you must pay for Part B (which can change every year). It will be deducted from your Social Security or Railroad Retirement check. If you are not drawing those, Medicare will collect the premium for 3 months at a time. This is insurance sold by private insurance companies, that can help pay some of the health care costs that Original Medicare does not cover, such as co-payments, coinsurance, and deductibles. This insurance “supplements” Original Medicare. Original Medicare pays first and then the supplement pays its portion. A Medigap plan is not the same as a Medicare Advantage plan. Medicare Advantage is a way to get Medicare benefits, but Medigap supplements your Original Medicare benefits. Medicare Supplement policies are the same across the US and must follow federal and state laws designed to protect you. Insurance companies can only sell a “standardized” policy categorized in most states by letters. (See the chart) All policies offer the same basic benefits but some offer additional benefits, so you can choose which one meets your needs. As you can see from the chart, there are many options to choose. As licensed agents, we can help you understand these plans and choose the right plan for you. These policies help cover prescription drug costs. You can sign up for Part D Prescription Drug Coverage 3 months before your 65th birthday. If you do not enroll by 3 months after your 65th birthday, you will get a late enrollment penalty that you must pay every month for the duration of your drug coverage. If you work passed your birthday and have credible coverage, you will not incur the late penalty, but you must enroll within 63 days of losing the credible coverage to avoid a penalty at that time. The late enrollment penalty is calculated by taking 1% times the national average premium times the number of months you did not have coverage. If you are already in a Part D stand-alone drug plan or a Medicare Advantage plan that includes drug coverage, you are able to switch plans during the annual enrollment period from Oct 15-Dec 7th each year. Elimination of Coverage Gap or Donut Hole Deductible Stage: If a member’s plan has a prescription drug deductible, they will pay the full cost for their drugs until they reach the deductible amount; then they move to the Initial Coverage stage. Initial Coverage Stage – Members will pay their plan copays or coinsurance, and the Part D plan (or Drug Manufacturers) will pay the rest. Once the member, and others on their behalf, have paid a combined total of $2,000 (including any amounts paid toward a deductible), they move to the Catastrophic Coverage stage. Catastrophic Coverage Stage: Members won’t pay anything for Part D covered drugs for the rest of the plan year. The Part D plan will be responsible for most costs in this stage The amount that is applied towards a members’ TROOP is the greater of the amount paid by a member based on their plan’s benefit design OR the cost share that the member would have under Medicare’s Defined Standard Part D Plan. The Defined Standard Part D Plan is CMS’ minimum benefit requirement for a Part D offering (either as a stand-alone PDP or within an MAPD plan). Many Medicare plans offer an enhanced Part D benefit instead of a Defined Standard benefit. Members on these plans may see their TROOP accumulation differ from their actual out-of-pocket costs All plans on the market this year will offer a (Budget Billing) MP3 Medicare Payment Prescription Plan option to pay for medications. It does not change the cost of the medicine, only how and when you pay it. It is not for everyone, but if your medications are really expensive it may be a better choice to pay a monthly premium to the carrier. It is vital to review your Part D coverage every year, especially if you are taking any new medicines. You can start by looking on Medicare.gov Enter your medicines and pharmacies to see all of the plan options. You can see the monthly costs for each medicine and the differences in pharmacy. Each plan has a preferred, standard, or out-of-network pharmacy. Most plans have a mail-order option as well. They can vary drastically from plan to plan. Contact us to check your medications for you, to make sure you are on the best-suited plan, and to explain any details you do not understand. Then let us do the enrollment for you. Individuals with low annual incomes may qualify for Extra Help from Medicare. Extra help helps pay your Part D premiums and out-of-pocket drug costs. Enroll using this link. https://www.ssa.gov/medicare/part-d-extra-help Medicare Advantage Plans (Part C) are health plans from private insurance companies. These plans generally cover all Medicare-covered healthcare and can include prescription drug coverage. There are 4 types: These plans generally offer extra benefits and lower co-payments than on Original Medicare. These are managed care plans that may require you to see doctors that belong to the plan or go to certain hospitals for services. Generally, Medicare Advantage plans include benefits such as dental, vision, hearing, OTC (health care products) and gym membership, many plans offer more than this also. There are special Medicare Advantage plans available specifically to honor the people that have served in our Military. These plans offer many additional benefits. To join a Medicare Advantage Plan, you must have Medicare Part A and Part B. You will need to continue to pay your monthly Part B premium to Medicare. The standard Part B premium amount for 2024 is $174.70 (depending on your income). Medicare limits when you can join, switch or drop a Medicare Advantage Plan. You can join anytime beginning 3 months before the month of your 65th birthday and 3 months after the month you turned 65. If you are on disability and have Social Security, you can join 3 months before to 3 months after month 25 of your disability. You can switch or drop your Medicare Advantage plan during Annual Enrollment Period each year between Oct 15-December 7th. Please contact us to go over all of your needs in detail and help you find a plan that fits you.To Watch a Short Video Presentation About Medicare Click Here

Medicare Basics

Medicare is made up of 3 parts:

Who is Eligible for Medicare?

Guidelines:

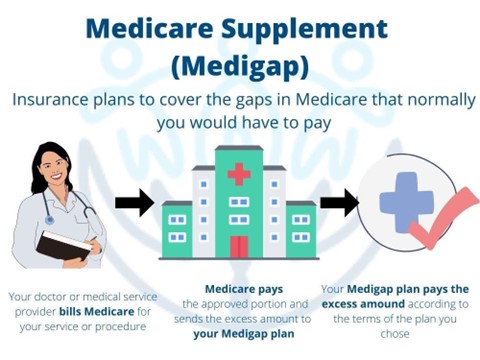

Medicare Supplement (Medigap) Insurance

What you should know about Medigap plans:

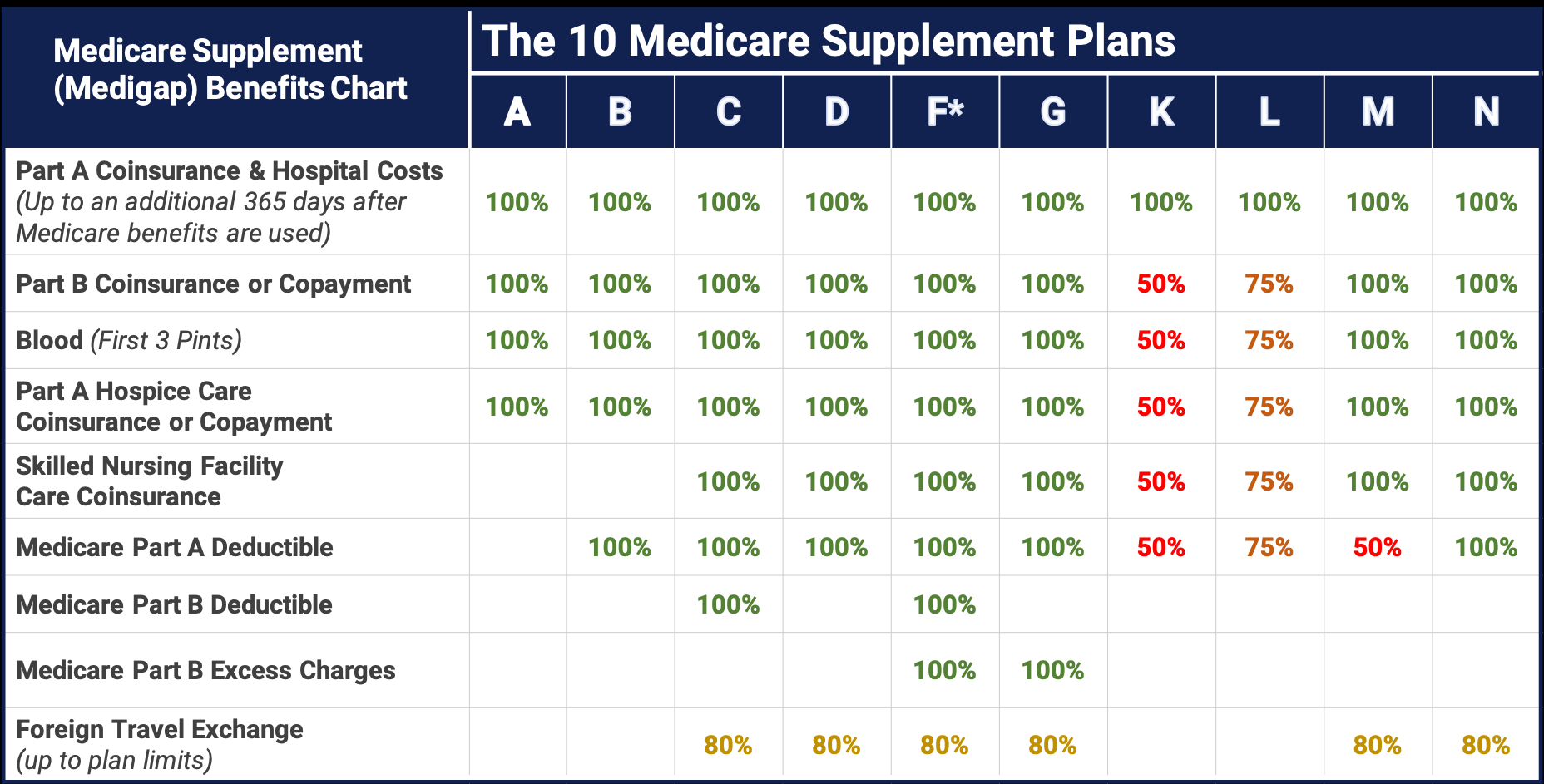

Comparing Medicare Supplements

Part D Prescription Drug Plans

Inflation Reduction Act of 2022

MP3 or Smoothing

Here are some examples of how the new drug plan structures work

How to choose a plan

Medicare Advantage Plans

When you can enroll