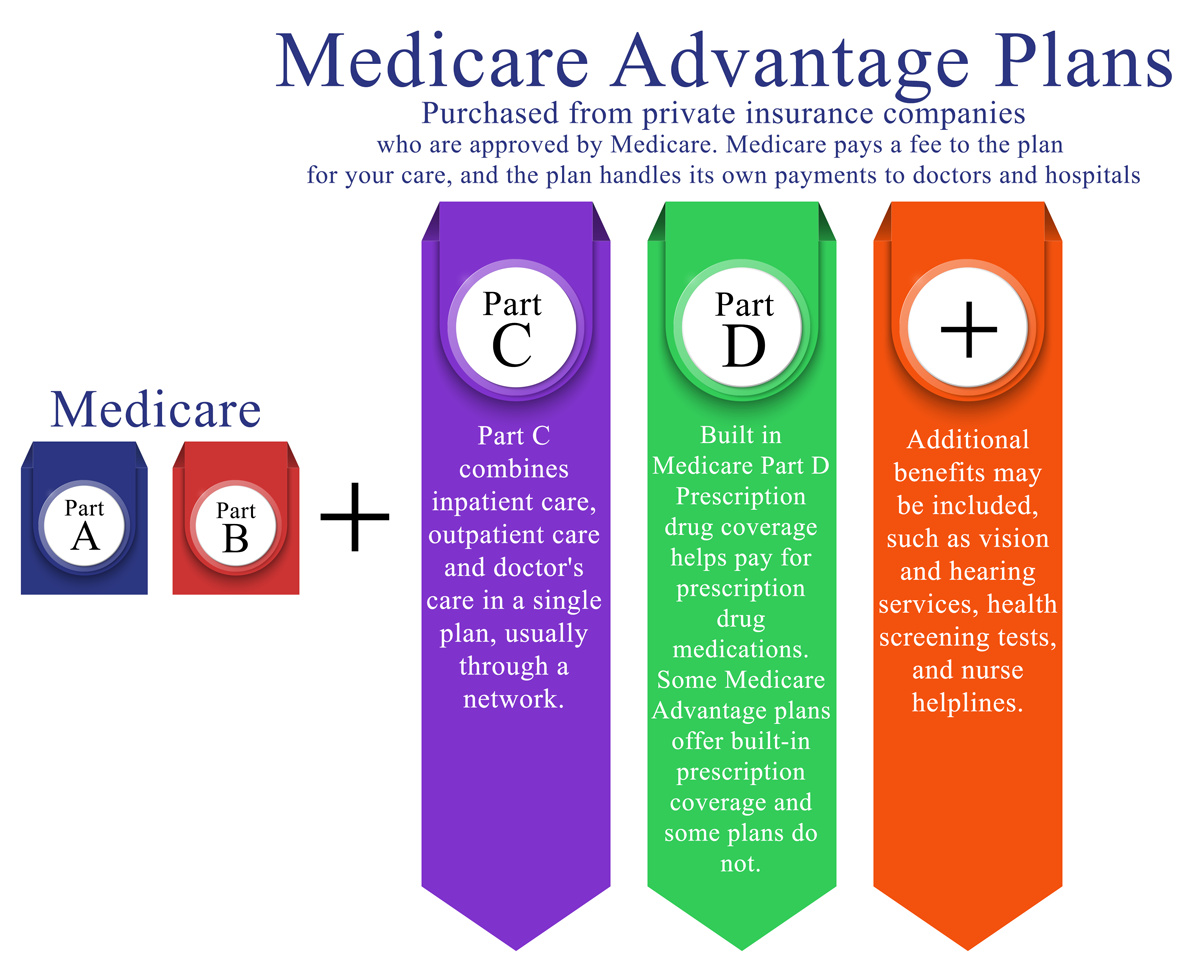

Medicare Advantage Plans (Part C) are health plans from private insurance companies. These plans generally cover all Medicare-covered healthcare and can include prescription drug coverage. There are 4 types:

- Medicare Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee -for-Service Plans

- Medicare Special Needs Plans

These plans generally offer extra benefits and lower co-payments than on Original Medicare. These are managed care plans that may require you to see doctors that belong to the plan or go to certain hospitals for services.

Generally, Medicare Advantage plans include benefits such as dental, vision, hearing, OTC (health care products) and gym membership, many plans offer more than this also.

There are special Medicare Advantage plans available specifically to honor the people that have served in our Military. These plans offer many additional benefits.

To join a Medicare Advantage Plan, you must have Medicare Part A and Part B. You will need to continue to pay your monthly Part B premium to Medicare. The standard Part B premium amount for 2023 is $164.90 (depending on your income).

When you can enroll

Medicare limits when you can join, switch, or drop a Medicare Advantage Plan. You can join anytime beginning 3 months before the month of your 65th birthday and 3 months after the month you turned 65.

If you are on disability and have Social Security, you can join 3 months before to 3 months after month 25 of your disability.

You can switch or drop your Medicare Advantage plan during Annual Enrollment Period each year between Oct 15-December 7th.

Please contact us to go over all of your needs in detail and help you find a plan that fits you.